Del Mar Photonics -

Business Development

Faraday Spectrum, building F

22222 Faraday Ave., Carlsbad, CA 92008

New R& D class building 8800 sft located in Carlsbad Research Center. Purchase contract was signed in 2005 even before grading began, so current value substantially exceed original price.

|

Front - South Elevation |

|

|

Back - North Elevation |

|

|

East Elevation |

West Elevation |

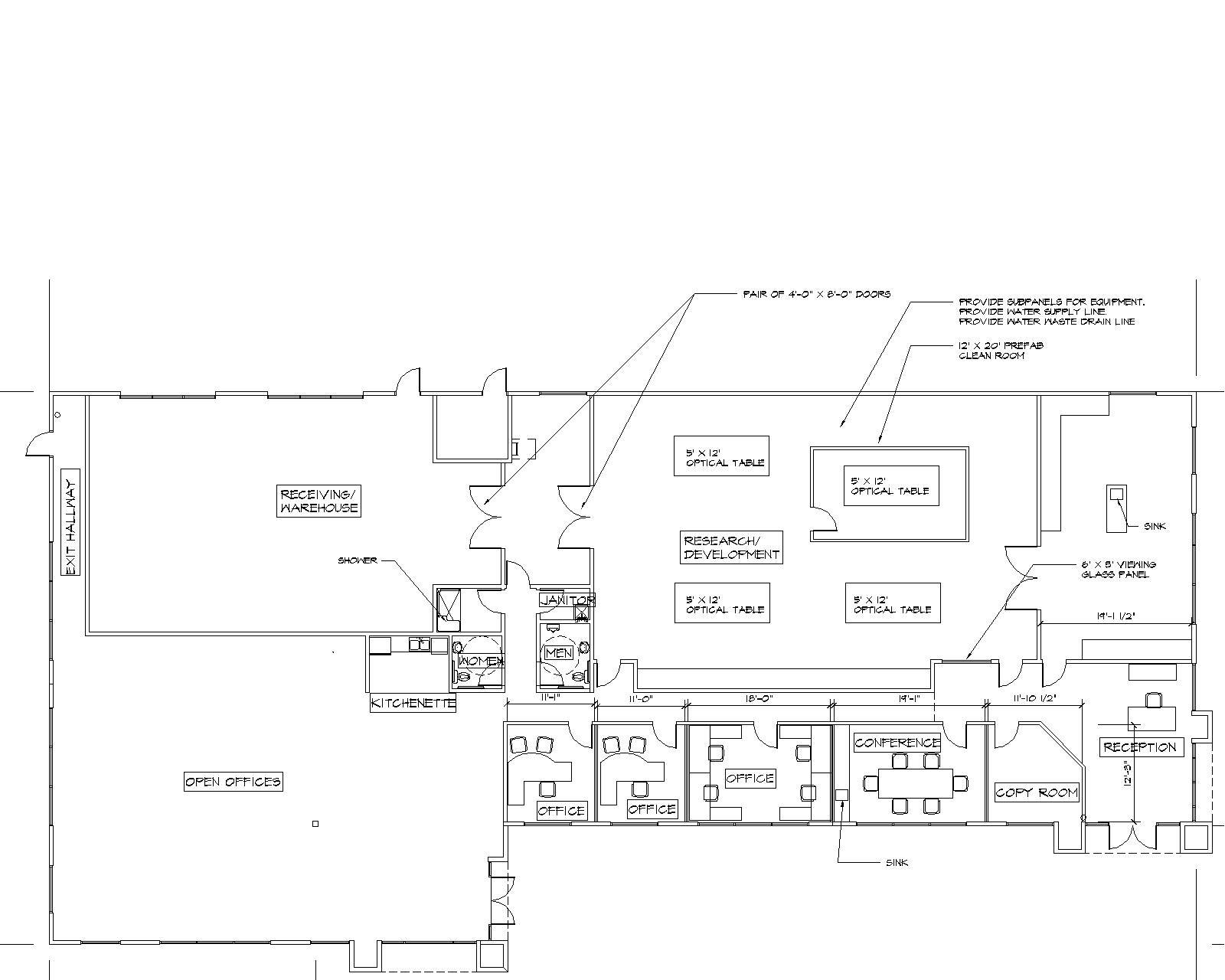

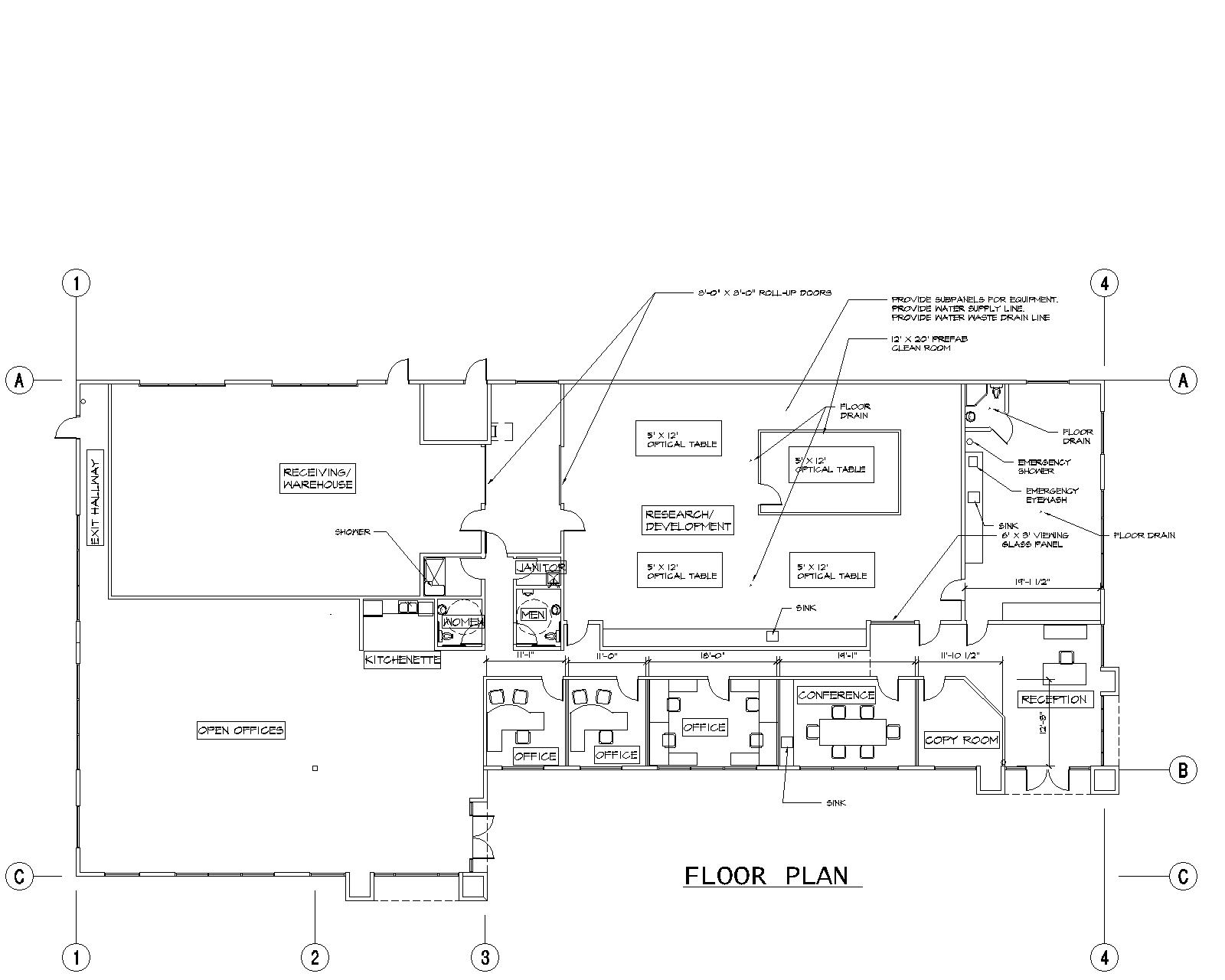

Proposed TI (Tenant Improvements)

|

|

In the news:

Tuesday, March 01, 2005 - CARLSBAD, CA-With land

increasingly scarce in the San Diego area, developers are searching throughout

the region and often becoming more creative in finding developable land. Such is

the case with land acquired by St. Croix Capital and its subsidiary, Kelly

Capital Corp. The company landed 4.6 acres of land on Faraday Avenue within the

Carlsbad Research Center.

Kelly Capital paid $3.7 million to EQBP-1, LLC, a Delaware Limited Liability

Co., for the land. Plans at the site call for a nine-building office/R&D project

that will be called Faraday Spectrum. Buildings will range in size from 3,000 sf

to roughly 14,000 sf. The total sf at build-out on the site was not available.

TSA Contracting is overseeing the construction of the project. Geoff Sherman has

joined the company as a senior project manager for the development. Estimated

completion for development the project is January 2006 and St. Croix is

currently accepting offers to purchase and lease the buildings. Dennis Visser,

SIOR, and Mark Emerick of Grubb & Ellis|BRE Commercial represented both parties

on the transaction and are marketing the project.

For St. Croix Capital, the Faraday Spectrum project marks the company's sixth

development in the area. The company has also developed the Canyon Ridge

Business Park, Carlsbad Crossroads I and II and several user build-to-suits.

Among the corporate clients in the area are

Callaway Golf,

Invitrogen,

Taylor Made,

Viasat and Cancer Vax.

CALIF. CARLSBAD, CALIF., April 4, 2005 – SARES•REGIS

Group, a leading West Coast real estate developer is pleased to announce it has

sold its first land parcel at Bressi Ranch Corporate Center in Carlsbad, Calif.

to Bressi Spectrum, LLC, an affiliate of Kelly Capital Group in conjunction with

St. Croix Capital Corporation for an undisclosed amount. The land parcel is

approximately nine acres and is located at the intersection of Palomar Airport

Road and Melrose Drive.

Bressi Ranch Corporate Center is a 132-acre, campus-style, mixed-use business

park that was purchased last year by SARES•REGIS Group for the development of

office, flex, R&D and light industrial projects and offers lots for sale or

build-to-suits for sale or lease. The master-planned development remains one of

the last large, contiguous parcels of developable land in San Diego County with

lot sizes ranging from 1.5 acres to 40 acres, some with ocean views. Upon

completion, the project will accommodate up to 2.1 million square feet of

development.

“We are proud to welcome Kelly Capital Group to Bressi Ranch Corporate Center,”

said Bruce Bearer, senior vice president at SARES•REGIS Group. “Carlsbad has

been one of the top performing cities in San Diego County for attracting

businesses, and Bressi Ranch Corporate Center offers a premier location for

companies looking to relocate or expand.”

Lannie Allee, Rick Sparks, Roger Carlson and Matt Strockis of CB Richard Ellis

are responsible for the marketing of Bressi Ranch Corporate Center for SARES•REGIS

Group and represented both the buyer and seller in this transaction.

“The opportunity to be a part of a high-end business park for both large and

small users has generated interest from a diverse group of companies,” said

Lannie Allee of CB Richard Ellis. According to the Allee, there has been a

significant amount of activity on the project and a number of the 39 remaining

land parcels are either in escrow or have letters of intent.

Kelly Capital Group in conjunction with St. Croix Capital Corporation plans to

develop 15 small, for-sale office buildings on the property, ranging in size

from 5,700 square feet to 15,000 square feet. The project is estimated to be

completed during the third quarter of 2006. Kelly Capital Group is also in

escrow to purchase an additional 14 acres to develop eleven R&D/Industrial

buildings for sale totaling approximately 186,000 square feet.

For more information on the project, contact Lannie Allee at CB Richard Ellis at

760.438.8590 or Bruce Bearer at SARES•REGIS Group at 949.809.2416.

About SARES•REGIS Group

The SARES•REGIS Group is one of the nation’s leading developers and managers of

commercial and residential real estate in the western United States. Currently,

the company has more than 5.7 million square feet of commercial and over 2,000

residential units under development. SARES•REGIS Group has a combined portfolio

of property and fee-based management contracts valued at more than $2.3 billion,

including 12,200 rental apartments and 14 million square feet of commercial and

industrial space. Since its inception the company has acquired or developed

approximately 36 million square feet of commercial properties and 18,000

multifamily and residential housing units.

About Kelly Capital Group / St. Croix Capital Corporation

These twin 20-year old companies act as the ownership and development arm of the

Satterlee Family Trust. They have been active in development in the southwest

since 1982, developing over 1.7 million square feet of office, industrial and

retail space. Notable Carlsbad projects include Ashworth Global Headquarters,

Randall International Corporate Headquarters, Carlsbad Crossroads Industrial

Park and The Island at Carlsbad Retail Shopping Center.

About CB Richard Ellis

Headquartered in Los Angeles, CB Richard Ellis is a leading global commercial

real estate services firm. With more than 13,500 employees in 220 principal

offices worldwide, the company serves real estate owners, investors and

occupiers. CB Richard Ellis' core services include strategic advice and

execution for property leasing and sales; property, facilities and project

management; corporate services; debt and equity financing; investment

management; valuation and appraisal; research and investment strategy; and

consulting.